Time value of money dictates that time affects the value of cash flows. Net Present Value (NPV) is the present value of cash flows at a specified discount rate compared to initial investment.

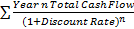

As a formula:

NPV =

Where: n = the year whose cash flow is being discounted

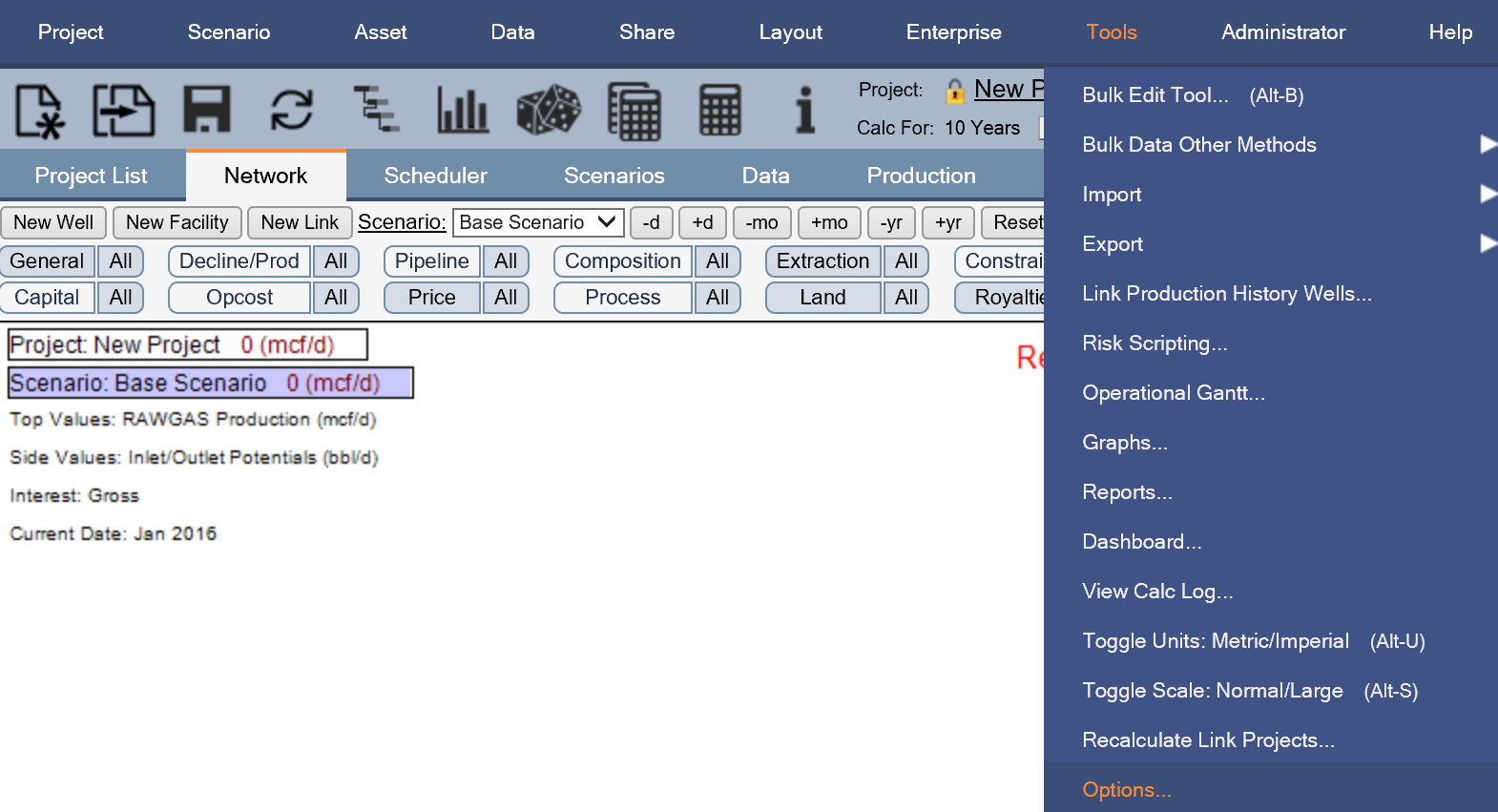

In Enersight, the Time Value Money options that impact NPV calculations can be set under the Global Options (apply to any projects loaded) and are specific to a user account:

Click image to expand or minimize.

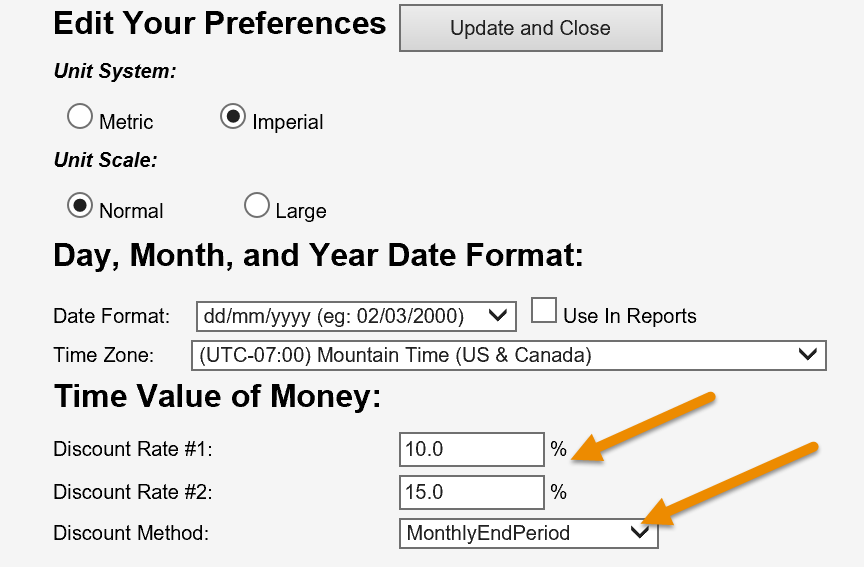

Discount Rates and Discount Method can be selected to alter the NPV values calculated:

Click image to expand or minimize.

Discounting method includes both Monthly and Annually.

Discount factors are 1/(1+r)^n

Where: r = the fractional discount rate

n = is the period.

There are four discounting methods available to users:

End period discounting n=0 to n-1 periods

Mid period n=1/2 to n-1/2 periods.

Beginning period n=1 to n periods.

To convert from "R" annual to r monthly, r = (1+R)^(1/12) - 1.

Use Annual Mid or End Period if you are trying to match a yearly spreadsheet model.